idaho sales tax rate 2020

Georgia sales tax rate. Arizona is the first state to use a.

Income and sales tax rates.

. The Tax Foundation an independent think tank weights local sales taxes by population and adds them to statewide sales taxes. Groceries and prescription drugs are exempt from the Colorado sales tax. And an average combined state and local sales tax rate of 602 percent.

Start filing your tax return now. You can print a 1025 sales tax table here. 2020 Idaho Association of School Business Officials IASBO Spring Workshop.

Sales tax rates differ by state but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy. Explore data on Idahos income tax sales tax gas tax property tax and business taxes. Check out our new video series on the 2022 tax season.

How Income Taxes Are Calculated. The Michigan sales tax rate is 6 as of 2022 and no local sales tax is collected in addition to the MI state tax. Educational Guide to Sales Tax in Idaho.

Exemptions to the Michigan sales tax will vary by state. The 85 sales tax rate in Atlanta consists of 4 Georgia state sales tax 26 Fulton County sales tax 15 Atlanta tax and 04 Special taxThe sales tax jurisdiction name is Atlanta Tsplost Tl which may refer to a local government divisionYou can print a 85 sales tax table hereFor tax rates in other cities see Georgia sales taxes by city and county. Counties and cities can charge an additional local sales tax of up to 71 for a maximum possible combined sales tax of 10.

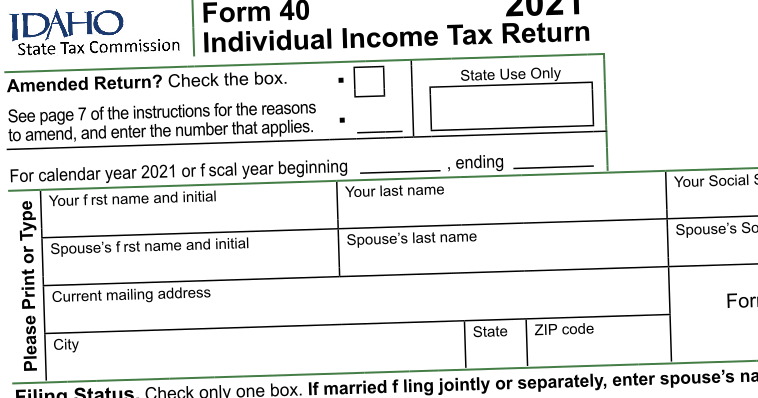

Idaho has a progressive income tax system that features a top rate of 650. Idaho ID Sales Tax Rates. Georgia state taxes 2020-2021.

Sales tax rates for items like food and telecommunications are lower than the state. In 2020 the threshold will be 150000 and then 100000 in 2021 and thereafter. Idaho state taxes 2021.

Although Texas has a set state sales tax rate. Learn about Idaho tax rates rankings and more. According to state law sellers who exceed the gross sales are required to register for an Arizona sales tax permit to collect transaction privilege tax TPT on sales that ship to Arizona and remit the sales tax to the state.

Alaska has no statewide sales tax but it allows cities and towns to levy sales taxes. The Idaho business tax rate is on taxable income. Illinois IL Sales Tax Rates.

Fri Jan 01 2021. Tennessees economic threshold is actually being lowered in 2020 from 500000 down to 100000. New Mexico reduced its sales tax rate from 5125 percent to 5 percent.

The sales tax jurisdiction name is Chicago Metro Pier And Exposition Authority District which may refer to a local government division. SalesUse Tax Hub Tax Pros Hub Or visit the Help Page to search. 2020 rates included for use while preparing your income tax deduction.

Idahos tax system ranks 17th overall on our 2022. Income and sales tax. Below is a history of tax rates.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. IFARMS and Others Combined Public School Funding Overview. Review these resources for more in-depth information.

The 1025 sales tax rate in Chicago consists of 625 Illinois state sales tax 175 Cook County sales tax 125 Chicago tax and 1 Special tax. Sales and property tax rates are relatively low in the state. Colorado has 560 special sales tax jurisdictions with local sales taxes in.

Four states Delaware Montana New Hampshire and Oregon have no statewide sales tax or local sales taxes either. First we calculate your adjusted gross. Sources of State and Local Tax Collections FY 2020 August 25 2022.

2020-2021 Tuition Rates and Excess Cost Rate. Sales tax rate differentials can induce consumers to shop across borders or buy products online. The Colorado state sales tax rate is 29 and the average CO sales tax after local surtaxes is 744.

2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 Calculate your tax rate based upon your taxable income the first two columns. Hawaii began requiring marketplace facilitators to collect and remit GET in 2020. Taxidahogovindrate For years.

How High Are Cell Phone Taxes In Your State Tax Foundation

Idaho Sales Use Tax Guide Avalara

Idaho State Income Tax Refund Status Id State Tax Brackets

Census 2020 Data Illustrates Idaho S Urban Rural Divide Idaho Capital Sun

Idaho Sales Tax Guide And Calculator 2022 Taxjar

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

Idaho State Taxes 2021 Income And Sales Tax Rates Bankrate

Idaho State Taxes 2021 Income And Sales Tax Rates Bankrate

U S Sales Taxes By State 2020 U S Tax Vatglobal

What S This Wayfair Fund I Keep Hearing About Idaho Reports

How To Register For A Sales Tax Permit Taxjar

Idaho Income Tax Calculator Smartasset

Idaho Sales Tax Rates By City County 2022

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates